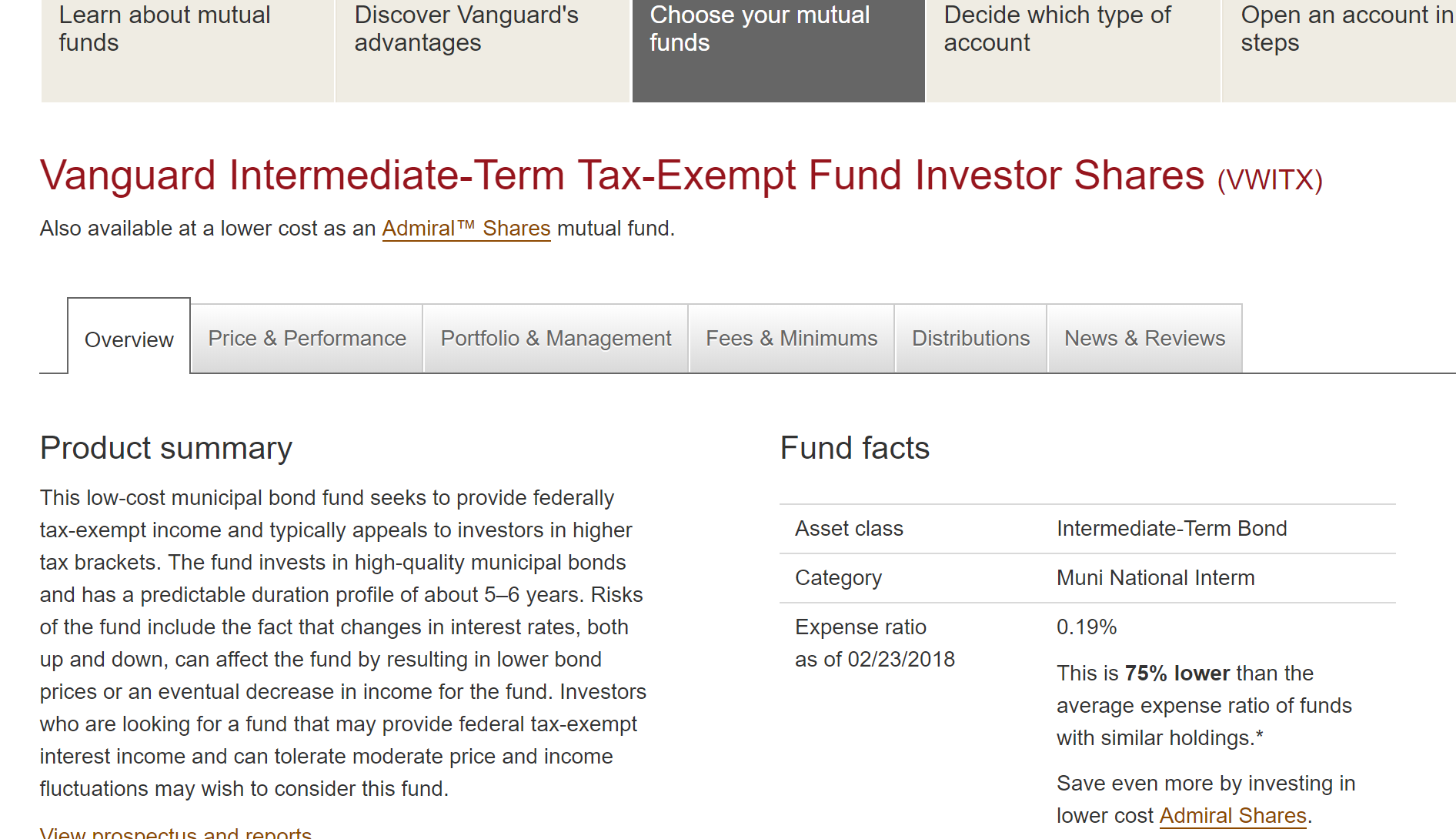

vanguard intermediate term tax exempt bond index fund

Fund Details Investment Policy The Fund seeks to track the performance of a market-weighted bond index with an intermediate-term dollar-weighted average maturity. Vanguard Intermediate-Term Tax-Exempt FundAdmiral Watch list Last Updated.

Vanguard Launching Esg Bond Etf Adviser Investments

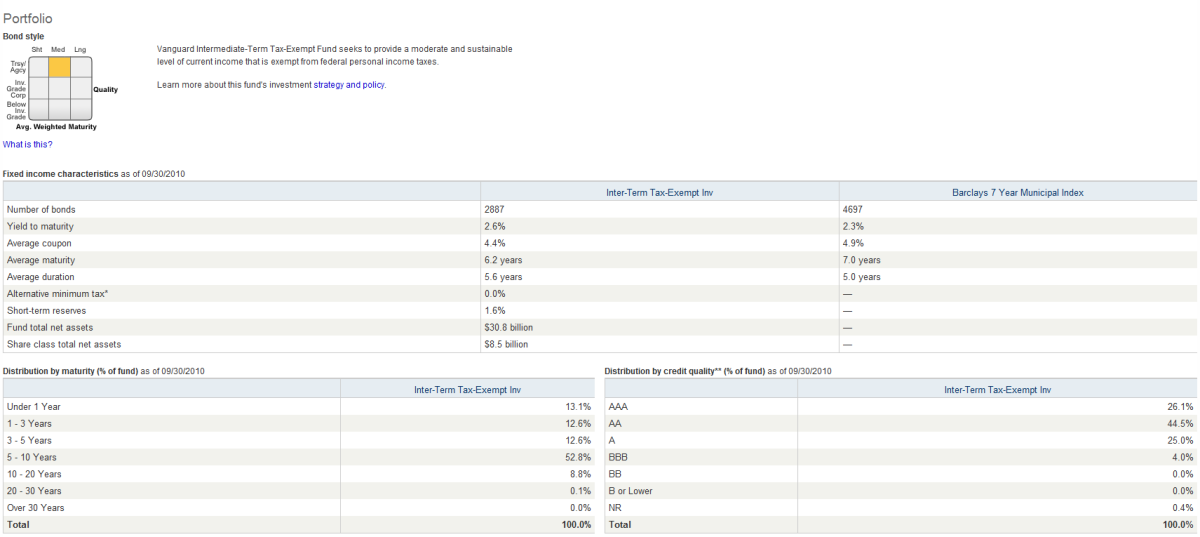

Vanguard Intermediate-Term Tax-Exempt Fund Investor Shares since 6282013 Portfolio Data More 30-Day Yield 4 365 10312022 Duration 508 Years.

. The Vanguard Intermediate Term Bond Index Fund is usually considered a candidate for placement in tax advantaged accounts. Vanguard Intermediate-Term Tax-Exempt FundAdmiral historical charts and prices financials and todays real-time VWIUX stock price. Vanguard mutual funds Vanguard ETFs Vanguard 529 portfolios.

Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans. The fund invests at least 80 of the funds net assets in municipal securities whose interest is exempt. If the company is a US.

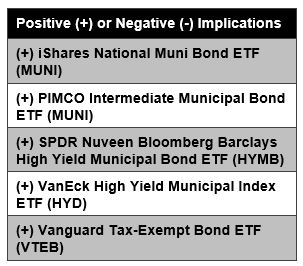

The fund is often recommended see Fig. 2012 is exempt from Indiana income tax. California Intermediate-Term Tax-Exempt Fund 100.

The Fund employs an. For mutual funds Indiana. Nov 23 2022 1328 002 015 Previous Close 1326 Advanced Charting 1284.

To see the profile for a specific Vanguard mutual fund ETF or 529 portfolio browse a list of all. SEE MORE VTEAX PERFORMANCE Fees Fees. The investment seeks current income exempt from federal income tax.

Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans. 1 as a core. NR securities may include a funds investment in Vanguard Market Liquidity Fund or Vanguard Municipal Cash Management Fund each of which invests in high-quality money market.

Bond funds and Vanguard Tax-Managed Balanced Fund. Vanguard funds that distributed qualified dividend income If your fund holds stock with a company that company will often distribute dividends. VWITX A complete Vanguard Intermediate-Term Tax-Exempt FundInvestor mutual fund overview by MarketWatch.

The fund has returned -1081 percent over the past year -179 percent over the past three years and 054 percent over the past five years. The fund has an average duration of approximately 6-10 years making its share price considerably more susceptible to changes in interest rates than shorter-term bond funds. Find the latest Vanguard Intermediate Term Tax-Exempt Fund VWITX stock quote history news and other vital information to help you with your stock trading and investing.

The chance that all or a portion of the tax-exempt income from municipal bonds held by the fund will be declared taxable possibly with retroactive effect because of. This mutual fund profile of the Inter-Term Tax-Exempt Inv provides details such as the fund objective average annual total returns after-tax returns initial minimum investment expense. View mutual fund news mutual fund market and.

Although the income from municipal bonds held by a fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own.

Here S How And Why To Invest In Iowa Municipal Bonds

Municipalbond Final Htm Generated By Sec Publisher For Sec Filing

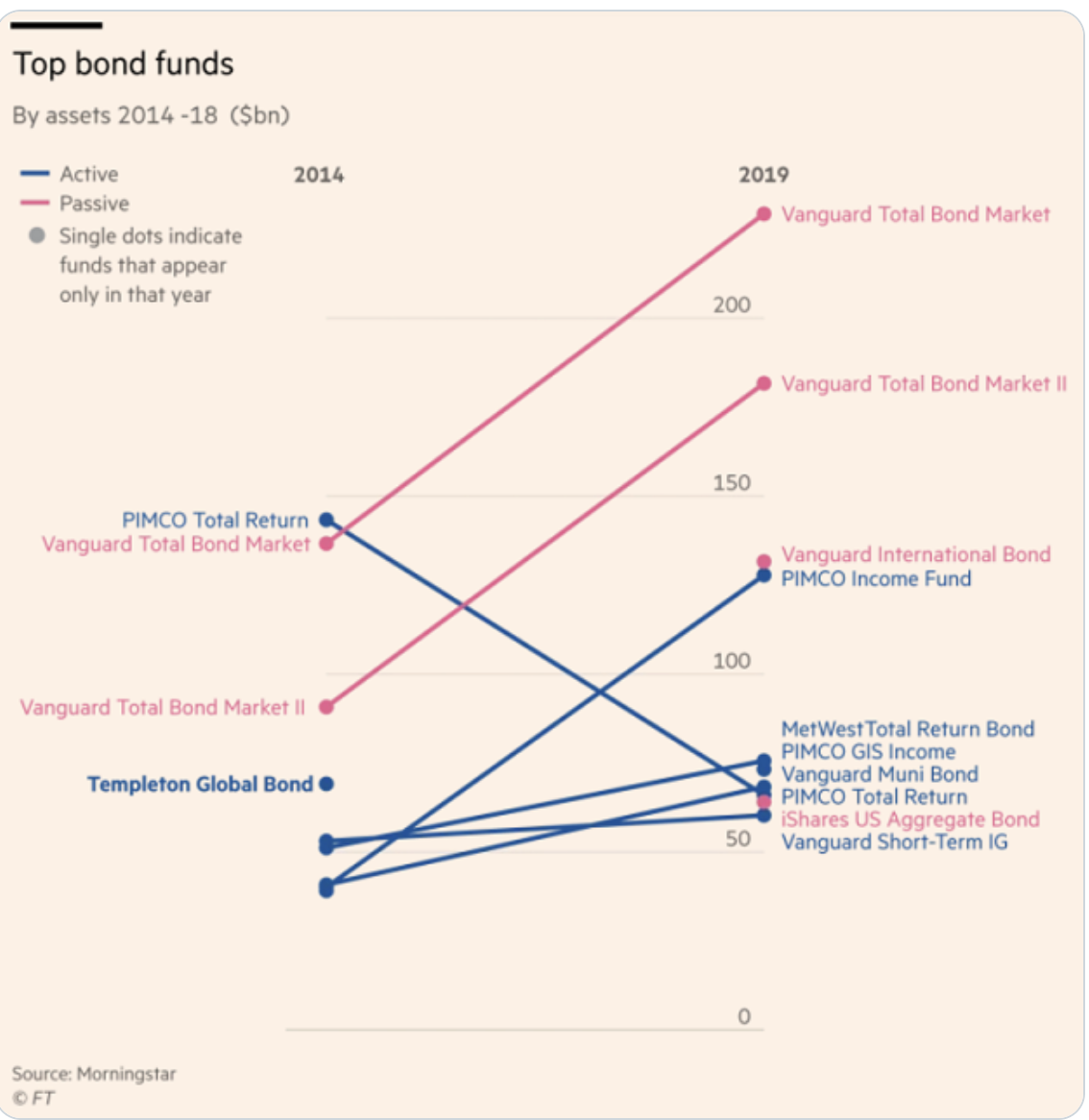

Vanguard Has World S 3 Largest Bond Funds The Big Picture

Vanguard To Expand Active Fixed Income Offerings With Broadly Diversified Core Bond Fund

Vwitx Vanguard Intermediate Term Tax Exempt Fund Investor Shares Portfolio Holdings Aum 13f 13g

Vanguard To Launch First Municipal Bond Index Fund And Etf Etf Express

A Smart Strategy For Municipal Bond Investors Barron S

How The Largest Bond Funds Fared In The First Quarter Morningstar

Vanguard Reports Third Round Of Expense Ratio Reductions Resulting In 143 Million In Cumulative Savings For Investors

:max_bytes(150000):strip_icc()/GettyImages-1216679280-224d1205d46948faadf21b2bf50ef1ce.jpg)

The Best Bond Index Funds To Buy From Vanguard And Fidelity

Master Custodian Agreement Vanguard Pennsylvania Tax Free Funds Ex 99 G Cust Agreemt March 28 2017

Vanguard Intermediate Term Tax Exempt Bond Fund Tax Distributions Bogleheads

Top 10 Best Tax Free Municipal Bond Mutual Funds Hubpages

Tax Loss Harvesting Treasury Bond Index Funds In 2022

Yield Split Method Of Asset Location To Reduce Tax Drag

Is Vanguard Tax Exempt Bond Much Riskier Than Vanguard Total Bond Bogleheads Org